Posts Tagged: PAYG Instalments

Are your PAYG or GST Instalments too high?

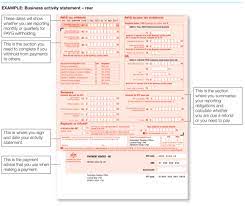

Quarterly BAS’s for the June 2022 quarter that contain GST or PAYG Instalments are due for lodgement this Thursday.

If your instalments for the year including June’s is close to the year’s actual liability then no action is required.

If either instalment is less then you will be asked to pay the shortfall by the time the 2022 Tax Return is lodged. You can though increase your June quarter instalment if you wish to not be sitting on the cash until May next year. This may also suit you if you are worried about not having the required funds when the shortfall(s) falls due.

But what if either instalment for June will take you well over what you are required to pay for the year?

If you do pay it, then it is not the end of the world as any excess amount will be refunded to you when the 2022 Tax Return is lodged. But why drain your funds in the meantime?

You are entitled to amend the instalment as issued by the ATO. But don’t get too carried away as the ATO does have the power to fine for gross under-estimates.

Do you think your instalments are too high? This is just one of the 67 items we address when undertaking pre year end reviews. So, if you are a client of ours then take comfort that we have already addressed this. If you are not a client, then we welcome a discussion.

I take the opportunity to state that the ATO has resumed normal operations. Since covid broke, they have not been chasing debts and lodgements. That has all changed as evidenced by the volume of letters and demands issued by the ATO since June. We have even heard of the ATO issuing Director Penalty Notices (DPN’s) to directors. DPN’s can be issued where a BAS obligation remains unreported and unpaid for more then 3 months. The scary part is that once issued, basically speaking, the only way to clear your now personal tax debt is to pay the tax due. Please don’t hesitate to call us if you are concerned about any request by the ATO.

End of instant asset write-off

If one incentive had clients jumping the last couple of years it was the instant asset write-off. Particularly last year when the limit was increased to $25,000 and then to $30,000.

As part of the stimulus measures, it has now been increased to $150,000 to 30th June 2020. And the small business threshold has been removed. A business with turnover of less than $500,000,000 can now use this concession!

In today’s environment, using this incentive may not be possible for many.

But beware!

From 1st July 2020, the instant asset write-off is set to reduce to only $1,000.

So as tough as things are, consideration should be given to buying needed business assets now to bring forward tax deductions. Not only will this save on income tax, it will have a flow on effect with reduced PAYG Instalments payable through 2020/21. We are not saying buy assets willy-nilly; we are simply saying seriously analyse the impact rather than dismiss it as a knee jerk reaction.

You might also find that you get good deals over the next few months.

Who else should consider this?

Those selling major assets to larger businesses. They might well have the cash flow to acquire assets others can’t. Make sure you tell them about this incentive. With much noise and unprecedented rapid, change, they may not be aware. You might be doing them a favour by telling them.

PAYG Instalments options

PAYG Instalments are income tax payments paid during the year by companies, super funds and individuals. In respect of individuals, it is levied on income not taxed upon receipt with common examples being interest, dividends and trust distributions. It is not assessed on wages or capital gains. With the September BAS being the first one for the year, one can choose how to calculate your PAYG Instalments.

We usually prefer that clients use the instalment amount method. In the majority of cases, it will not result in an over-payment that can so often arise under the instalment rate method.

In some cases though, the % rate method may enable one to pay a lesser amount. If the instalment income is nil or negligible in the first couple of quarters or much less than the year before, then no or little tax will be paid. A significant payment will only be required at such time as income is received.

It is critical with PAYG Instalments (and indeed GST Instalments) that any downwards or indeed upwards variation be made cautiously. If a variation results in the instalments paid being 15% less than the actual liability then the ATO will issue a fine.

Please do not hesitate to call us should you wish to discuss your own situation.

At MRS, we will spend today planning for your success tomorrow.

Small business tax breaks

Now that a small business is defined by the ATO as one with group turnover under $10,000,000, there are many more businesses that can avail themselves of the many and valuable small business tax breaks.

The tax breaks can be summarised as follows:-

- A company tax rate of 27.5%. Please note that companies with non-business income (that is “passive” income from investments, rents and trust distributions) will continue to pay company tax at 30%. Please also note though that small businesses will only be able to frank dividends at 27.5% so any tax saving is short lived if most profits are paid out as dividends.

- The Small Business Income Tax Offset of up to $1,000 for non-corporate businesses (that is sole traders or those who receive a share of partnership or trust business income).

- The choice to use the simplified depreciation rules. This is important for those businesses who wish to purchase assets costing less than $20,000 (ex GST) before July 2018. Please see our past blogs for further details.

- The choice to use a simplified trading stock rules under which one can estimate their stock if they believe it is not changed by more than $5,000 (which probably means you need to do a stock take anyway).

- The ability to claim prepayments (such as insurance and prepayments rents & interest).

- 100% write-off of start-up expenses.

- The ability to elect to pay GST on a cash basis.

- The option to pay fixed dollar instalment amounts of GST.

- The option to pay fixed dollar amounts of PAYG Instalments.

- Access to the FBT car parking exemption.

- The ability to provide employees with multiple work related portable electronic devices (lap-tops, tablets, calculators, GPS navigation receivers and mobiles) within the one year and free of FBT.

- The ability to use the free ATO Small Business Superannuation Clearing House.

- The ability to restructure under the new small business CGT restructure rollover relief provisions. Please note though that the small business CGT concessions are still only available to those businesses with group turnover under $2,000,000 and/or net asset value under $6,000,000.

So what does this mean to you?

It depends on what you are trying to achieve. There are occasions where we have and haven’t used these rules depending on the short and/or long-term benefits to our clients. Grabbing at shiny red apples hanging on a tree is no substitute for proper planning. We address these opportunities throughout the year, particularly so when undertaking pre year end tax planning review of our clients.

If this is all news to you then you should be looking for a new accountant. We welcome your call.

At MRS, we will spend today planning for your success tomorrow.