Monthly Archives: July 2022

Are you complying with your new landlord obligations?

Are you complying with your new landlord obligations?

There has been a lot of covid noise over the last 2 years so perhaps you might have missed this new obligation.

A landlord musty ensure a residential property meets basic minimum standards for leases entered into from 29th March 2021. It also applies to fixed term agreements that rolled over into periodical agreements after that date (that is leases that become monthly upon the end of the lease term).

There are 13 minimum standards (with a 14th of electrical safety from 2023):-

- Door locks

- Bins

- Toilets

- Bathrooms

- Kitchens

- Laundry

- Structural soundness

- Mould and dampness

- Window coverings

- Windows

- Lighting

- Ventilation

- Heating

It is your obligation as a landlord to ensure that these standards are met.

It has come to our attention that some agents are trying to circumvent this by just having the landlord sign something.

I would hate to think where such landlords would sit if something went wrong.

A proper way to attend you is to have your property inspected by a building inspector that way you fulfill your needs. You also have the added benefit of knowing your investment is in good condition or need of repair before it becomes more costly. How would you know or even know to identify if there was early termite infestation under the sub floor?

We have had dealings with a number of building inspectors across Melbourne and would be happy to give you an introduction.

You can also read more about landlord obligations at www.consumer.vic.gov.au/housing/renting

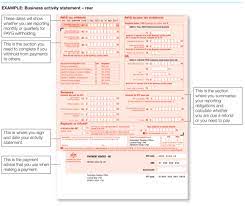

Are your PAYG or GST Instalments too high?

Quarterly BAS’s for the June 2022 quarter that contain GST or PAYG Instalments are due for lodgement this Thursday.

If your instalments for the year including June’s is close to the year’s actual liability then no action is required.

If either instalment is less then you will be asked to pay the shortfall by the time the 2022 Tax Return is lodged. You can though increase your June quarter instalment if you wish to not be sitting on the cash until May next year. This may also suit you if you are worried about not having the required funds when the shortfall(s) falls due.

But what if either instalment for June will take you well over what you are required to pay for the year?

If you do pay it, then it is not the end of the world as any excess amount will be refunded to you when the 2022 Tax Return is lodged. But why drain your funds in the meantime?

You are entitled to amend the instalment as issued by the ATO. But don’t get too carried away as the ATO does have the power to fine for gross under-estimates.

Do you think your instalments are too high? This is just one of the 67 items we address when undertaking pre year end reviews. So, if you are a client of ours then take comfort that we have already addressed this. If you are not a client, then we welcome a discussion.

I take the opportunity to state that the ATO has resumed normal operations. Since covid broke, they have not been chasing debts and lodgements. That has all changed as evidenced by the volume of letters and demands issued by the ATO since June. We have even heard of the ATO issuing Director Penalty Notices (DPN’s) to directors. DPN’s can be issued where a BAS obligation remains unreported and unpaid for more then 3 months. The scary part is that once issued, basically speaking, the only way to clear your now personal tax debt is to pay the tax due. Please don’t hesitate to call us if you are concerned about any request by the ATO.

June quarter employer obligations

There are a number of important employer obligations that you will need to satisfy by 28th July.

Whilst 28th July is the end date for paying the June quarter SG super, payments through clearing houses can take up to 6 to 10 days. We therefore recommend that you pay your June quarter super today if you have not done so already.

Those larger employers that are subject to Pay-roll Tax are due to certify the 2021/22 remuneration by 21st July. One needs to be careful as in addition to wages, salaries, commissions, directors fees, bonuses and so on, Pay-roll tax is also payable on:-

- Superannuation

- Some fringe benefits

- Payments to certain contractors (including some corporates).

Although you may have a WorkCover lodgement date as late as March next year, it would also be prudent to certify your 2021/22 WorkCover remuneration now.

We take this opportunity to remind you that 14th July was the due date for Single Touch Payroll finalisations (with extended dates for closely held employees).

We welcome any question you may have about these matters.