Posts Categorized: Tax

Stage 3 tax cuts and you

After much speculation, the Government has announced that they will amend the legislated Stage 3 tax cuts scheduled to commence on 1 July 2024. This will mean that more Australian taxpayers will receive a personal income tax cut and take home more in their pay packet from 1 July, but for some, the impact will be less favourable than it would have been prior to the redesign.

What will change?

The revised tax cuts redistribute the reforms to benefit lower income households that have been disproportionately impacted by cost of living pressures.

So under the proposed redesign, all resident taxpayers with taxable income under $146,486, who would actually have an income tax liability, will receive a larger tax cut compared with the existing Stage 3 plan. For example:

- An individual with taxable income of $40,000 will receive a tax cut of $654, in contrast to receiving no tax cut under the current Stage 3 plan (but they are likely to have benefited from the tax cuts at Stage 1 and Stage 2).

- And an individual with taxable income of $100,000 would receive a tax cut of $2,179, which is $804 more than under the current Stage 3 plan.

However, an individual earning $200,000 will have the benefit of the Stage 3 plan slashed to around half of what was expected from $9,075 to $4,529. There is still a benefit compared with current tax rates, just not as much.

There is additional relief for low-income earners with the Medicare Levy low-income thresholds expected to increase by 7.1% in line with inflation. It is expected that an individual will not start paying the 2% Medicare Levy until their income reaches $32,500 (up from $26,000).

While the proposed redesign is intended to be broadly revenue neutral compared with the existing budgeted Stage 3 plan, it will cost around $1bn more over the next four years before bracket creep starts to diminish the gains.

How did we get here?

Tax cuts delivered in 3 stages were first announced in the 2018-19 Federal Budget. The personal income tax plan was designed to address the very real issue of ‘bracket creep’ – tax rates not keeping pace with growth in wages and increasing the tax paid by individuals over time.

The three stage plan sought to restructure the personal income tax rates by simplifying the tax thresholds and rates, reducing the tax burden on many individuals and bringing Australia into line with some of our neighbours (i.e., New Zealand’s top marginal tax rate is 39% applying to incomes above $180,000).

Stage 1 tax cuts took effect from 1st July 2018.

Stage 2 tax cuts took effect from 1st July 2020.

Stage 3 as legislated were due to to take effect from 1 July 2024 – but will now change as per the following table.

The current, legislated and re-designed Stage 3 rates for Australian tax residents are:-

| Tax rate | 2023-24 | 2024-25 legislated | 2024-25 proposed |

| 0% | $0 – $18,200 | $0 – $18,200 | $0 – $18,200 |

| 16% | $18,201 – $45,000 | ||

| 19% | $18,201 – $45,000 | $18,201 – $45,000 | |

| 30% | $45,001 – $200,000 | $45,001 – $135,000 | |

| 32.5% | $45,001 – $120,000 | ||

| 37% | $120,001 – $180,000 | $135,001 – $190,000 | |

| 45% | >$180,000 | >$200,000 | >$190,000 |

Any concerns?

If you have any concerns about the impact of the proposed changes please just give us a call.

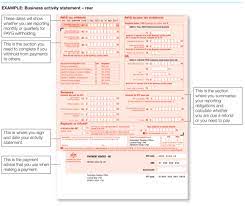

SG deadline reminder for Dec 23 qtr

I trust you had an enjoyable festive season – but it is now time to focus on time critical obligations. So here is a quick SG deadline reminder.

With the 28th falling on the weekend and the Australia Day public holiday on the 26th, Thursday 27th January is the end date for satisfying your Super Guarantee (SG) super obligations for the December 2023 quarter.

Please make sure you do not confuse this obligation with the December quarter BAS. The December quarter BAS automatically has a one month extension to 28th February . There are no extensions for reporting and payment of SG super.

Please note that super clearing houses can take up to 8 days to pass the money through to the super fund. It therefore means that processing and payment to the clearing should be made as soon as possible.

And please make sure you have been calculating super at 11%% since it increased on 1st July 2023.

Please refer to our previous quarterly reminder as to what forms of remuneration are subject to and not subject to Superannuation Guarantee.

SG super should never be paid late as late payments attract substantial interest and penalties. Furthermore, SG (and BAS) liabilities that remain unreported and unpaid after 3 months automatically can become personal debts of directors.

We welcome any questions you might have.

Christmas & tax (& FBT & GST)

Entertaining and providing gifts at Christmas time to staff, customers and suppliers is a cost of doing business. However, there are some important FBT, GST and income tax considerations and outcomes to keep in mind.

As an employer, you need to be careful at what you provide at Christmas. The rules are complex and the costs of getting it wrong can prove very expensive.

We will outline some of the more common scenarios and what to be careful of.

Under-pinning the implications are the following key points:-

- Christmas parties, entertainment and gifts are all treated under entertainment tax rules.

- FBT applies to benefits given to employees.

- There are no FBT implications on entertainment and gifts given to customers, clients and suppliers.

- A business can adopt one of three methods to quantify the taxable components of any entertainment expenditure – in fact there are 38 permutations depending on who is entertained where, how and with whom. We will largely address the actual method which is the one used by most small businesses (as it usually results in the best outcome). It is beyond the scope of this briefing to address the 12 week log method and we will only touch upon the 50/50 method where relevant.

- Christmas comes but once a year and to the best of my knowledge and experience does so on 25th Nevertheless, the ATO treats Christmas parties and gifts as being what are called minor, infrequent and irregular benefits.

- Such minor benefits are FBT exempt where they cost less than $300 (including GST) provided the actual method is used to quantify entertainment.

The Christmas party

Where entertainment is calculated under the actual expenditure method (which is the most common method for small businesses):-

- A Christmas party is held on-site on a work day, the whole cost for each employee will be an exempt fringe benefit. So too will the spouse’s cost provided the cost per spouse is less than $300. No income tax deduction can be claimed for the cost of the party including that in respect of any family members that may attend. Taxi travel to or from the workplace (not both ways) will be exempt from FBT and not tax deductible.

- When a Christmas party is held off the work premises, then the whole cost will be exempt from FBT provided the party costs less than $300 per person (employees and their spouses). No income tax deduction can be claimed for the cost of the party including that in respect of any family members that may attend.

- If an external Christmas party costs more than $300 or more per person then the total cost is subject to FBT.

- The cost of any entertainment provided during the party (whether that be at the work premises or outside) will be exempt if it costs less than $300 per head – for example a DJ, musician, clown and comedian.

- The cost of entertaining clients, customers and suppliers is not subject to FBT and is not tax deductible.

- Where any exemption is exceeded then FBT is payable. Consequently, an FBT Tax Return must be lodged and FBT paid (the FBT tax rate being the same as the top marginal tax rate). Please keep this in mind when completing the 2018/19 FBT Questionnaire in early April 2019.

- All other entertainment during the year will be subject to FBT on a case by case basis.

Where entertainment is calculated under the 50/50 method:-

- 50% of the cost will be subject to FBT and this portion will be tax deductible. The other 50% will not be subject to FBT and will not be tax deductible. An FBT Tax Return must be lodged and FBT paid.

- Only taxi travel from home to the venue will be FBT exempt and not deductible for tax.

- 50% of all other entertainment during the year will be subject to FBT.

Gifts

The following gifts are exempt from FBT and are tax deductible:-

- Hampers, bottles of wine, gift vouchers, a pen set costing less than $300 (inclusive of GST).

The following gifts are subject to FBT and are not tax deductible:-

- Tickets to a sporting event or theatre, holiday, accommodation, etc.

The GST treatment of gifts is:-

- That the GST component of any tax deductible portion can be claimed back.

- But the GST component that relates to the non tax deductible portion can’t be claimed.

Please do not hesitate to call us should you have any queries.

Reminder about new home office deductions rules

We are returning to the important changes to home office deductions; in particular, how the ATO now requires you to prove the hours you have worked from home to continue to claim under the cents per hour / fixed rate method.

You need to comply with the new requirements in order to make a claim for this 2023/24 year. We cannot emphasise enough the requirement to keep actual records of all hours worked at home or have access to timesheets or roster records (if kept/accessible).

What are the key changes?

The ATO has re-set the rules for taxpayers who are working from home and wish to claim deductions based on either:

- actual expenses, or

- revised fix rate method of 67 cents per hour.

A key and indeed welcome change is that you do not need to have a separate home office or dedicated work area set aside in your home in order to rely on the fixed rate method.

Also, if more than one individual is working from home at the same time, each individual will be able to apply the fixed rate method if they each meet the requirements listed above.

To be eligible to claim tax deductions for working from home expenses, you must:

- incur additional running expenses as a result of working from home

- be working from home to fulfil your employment duties, not just completing minimal tasks

- keep records at the time you work to prove you incur the cost.

Revised Fixed Rate Method

The revised fix rate method:

- has increased from 52 cents to 67 cents per hour worked from home

- removes the requirement to have a dedicated home office space

- includes claims for:

- data and internet

- mobile and home phone usage

- electricity and gas

- computer consumables (e.g. printer ink)

- stationery

- allows taxpayers to separately claim the work-related portion of:

- immediate deduction for items that cost less than $300 (e.g. keyboards, computer mouses, power boards, desk lamps and chargers)

- depreciation of office furniture and computers (items that cost more than $300)

- repairs and maintenance of these assets

- cleaning (only if you have a dedicated home office)

Actual Cost Method

The actual cost method allows you to claim a tax deduction for the actual expenses you incur as a result of working from home.

Using this method, you are required to keep an invoice/receipt for every expense you claim.

Expenses You Can’t Claim

The ATO has stated that you can’t claim a tax deduction for:

- coffee, tea, milk and other general household items, even if your employer may provide these at work

- costs that relate to your children’s education, such as equipment you buy – for example, iPads and desks, subscriptions for online learning

- items your employer provides – for example, a laptop or a mobile phone

- expenses where your employer reimburses you for the cost.

VERY IMPORTANT: The records you need to keep for the fixed rate method

You need to keep record of the total number of actual hours you worked from home to prove your fixed rate method working from home tax deductions for the 2024 financial year onwards.

To claim your working from home deduction using this method, you must keep:

- a record of the number of actual hours you work from home during the entire income year – for example, a timesheet, roster, diary or other similar document.

- at least one record for each of the additional running expenses you incur that the rate per work hour includes – for example, if you incurred electricity and stationery expenses keep one quarterly bill for your electricity expenses and one receipt for your stationery expenses.

Next steps

It has come to our attention that some clients have not been keeping record of the hours worked at home – that being one of:-

- timesheets

- rosters

- a diary or similar document kept contemporaneously.

We have therefore built a spreadsheet for you to use and which you can download here – 2023-24 Home Office Expenses – hours worked log

You must also keep evidence for each of the additional running expenses that you incurred. The documents you need to keep in order to demonstrate that you have incurred additional running expenses must show what the expense is and that you incurred the expense.

For energy, mobile and/or home telephone and internet expenses, you must keep one monthly or quarterly bill. If the bill is not in your name, you will also have to keep additional evidence showing you incurred the expenses; for example, a joint credit card statement showing payment or a lease agreement showing you share the property, and therefore the expenses, with others.

For stationery and computer consumables, which are occasional expenses, you must keep one receipt for each item purchased.

Please feel free to contact our office and speak with one of our expert accountants if you need any assistance with this so we can help you to maximise your tax deductions in your 2024 and future year Tax Returns.

Where do I stand to win and lose from the Budget?

Shades of déjà vu

Just like the last Budget handed down by the Liberals in May 2022, there is less change than normal. This is evidenced by research houses analysis papers again being a third if not half the size of normal budget analytical papers.

But there remain significant matters of interest for all.

Some losers.

But a few wins.

So here is our analysis of where you stand to win, where you will lose and what we will be discussing with you as part of pre year tax planning and beyond. And as I remarked in our initial Budget paper on Wednesday, for most there is more interest in what wasn’t announced or clarified.

So what won’t be continuing?

The following are arguably the biggest impacts following this Budget:-

- The instant asset write-off will end on 30th June 2023. The good news is that we will now not returning to a $1,000 limit – it will be $20,000. More on this later.

- It was surprising and arguably unjustified that previous government extended the 50% minimum pension requirement into 2022/23. But there is no change to the position that minimum pension payments return to full rates for the 2022/23 and beyond. This means self managed super funds will need to be more careful about being cashed up enough (noting we track that minimum pensions have been paid and follow up those who are still underpaid close to 30th June). Whether you need that extra money or not the minimum must be paid – and careful analysis of whether you can re-contribute it will be required before doing so.

- Many of our clients have benefited from the Low Middle Income Tax Offset (LMITO). The Liberals had already legislated that it ended 30th June 2022 – and that hasn’t changed. Consequently many taxpayers’ 2023 tax refund will be $1,500 less (but $3,000 to many dual income families) – which could come as a rude shock to those battling the cost of living.

Businesses

$20,000 instant asset write-off

This is welcome news to all as a $1,000 limit from 1st July 2023 was not going to give much of a tax break.

For the 2023/24 gear, a $20,000 threshold will apply.

TIP It applies per asset. Nor are like assets grouped. So you could spend $100,000 on multiple assets and claim $100,000 for tax (so if your business is operated via a company it will pay $25,000 less tax).

TRAP The $20,000 includes GST – so the threshold is really $18,181 (but $20,000 if buying an asset from a business which is not registered for GST or from the public).

TRAP A group turnover test of $10,000,000 now applies.

TRAP Although more applicable to the open limit instant asset write-off, it would be remiss not to mention the upcoming sting in the tail for some businesses. It has been great for cash flow to write-off the cost of say a $50,000 car. However, the day may soon come when that car is sold. And given the ever lingering supply chain problems, one may be able to sell it for $35,000 or $40,000. And that will be straight profit – as the car has already been written down to nil. So a car traded in during June 2024 will see a couple of weeks depreciation being claimed but the entire ex-GST proceeds of the traded in car being fully taxable.

TIP For some, it may be best to delay the sale by say a couple of weeks into a new financial year (which is not that far away).

TRAP If your company will make a loss for 2023/24 or has carried forward losses, there will be no immediate tax saving (not until future profits exceed losses).

New energy incentive for small & medium businesses

Business with group turnover under $50,000 will be able to deduct an extra 20% on up to $100,000 of expenditure on eligible depreciating assets. Qualifying assets are:-

- More efficient electrical goods (eg fridges).

- Assets that support electrification (eg heat pumps and cooling systems).

- Demand management assets (eg batteries).

TIP Must be installed between 1st July 2023 and 30th June 2024.

TRAP Electrical vehicles don’t qualify for this incentive.

Lodgement program amnesty

An amnesty will open from 1st June 2023 for businesses with group turnover under $10,000,000 that haven’t lodged activity statements that were originally due between 1st December 2019 to 28th February 2022. A concession if you will to covid in an attempt to get businesses back into the tax system. Failure to lodge penalties will be remitted under this amnesty.

It would be unfortunate if a company found themselves qualifying for this as GST, PAYG WH and SG super that remain unreported and unpaid for longer than 3 months leave a director open to the ATO issuing a Directors Penalty Notice against a director. Effectively, a DPN makes the company’s debt a personal debt of a director – and the only way out is to pay it.

TIP If a business owner has unlodged activity statements from that period they would be mad not to ensure they were lodged under the amnesty. Not only does it remove the possibility of being served a DPN but amnesties such as these are followed by audit programs.

FBT exemption for electric cars

This exemption announced last year was indeed welcome news. Perhaps understandably the exemption for plug-in hybrid cars will cease from 1st April 2025.

PAYG Instalment relief

Inflation has reared its head in so many unwanted ways. One such manifestation is that the ATO formula has seen the indexation of the instalments increase to 12%.

The rate for small businesses and individuals will be reduced to 6%.

TIP Our pre year end tax planning checklist of some 67 items reviews current profits against instalments paid to date and the June one to determine whether the June instalment can be varied.

TRAP This relief only applies to small businesses. Businesses with group turnover over $50,000,000 will continue to be assessed under a 12% uplift factor.

Technology investment boost

This was announced in last year’s Budget – but it remains unlegislated. It grants an extra 20% deduction on expenditure up to $100,000 incurred between 29th March 2022 to 30th June 2023.

TRAP A company only stands to benefit up to $5,000 given the 25% company income tax rate. Savings to trust will depend on the beneficiaries’ marginal tax rate.

TRAP With few sitting days until 30th June this may well fail to be enacted.

TRAP If your company will make a loss for 2022/23 or has carried forward losses, there will be no immediate tax saving (not until future profits exceed losses).

Cyber security funding

A funding program will be set up to assist small businesses protect themselves against cyber threats. But don’t get too excited as the funding allotted won’t be enough to support less than 1% of all small businesses in Australia.

Individuals

PAYG Instalment relief

The indexation formula will be halved as per above for businesses.

Short term rental properties

A program will be set up to review deductions claimed against short term rental income.

Superannuation

Removal of delayed quarterly payment of SG super

Currently, employers have until 28 days after the end of each quarter to pay their employees super.

From 1st July 2026, employers will be required to pay the super on the day of the pay run.

TRAP Employers will need to ensure that have sufficient funds to pay the super at every pay run (noting that the penalties are huge for paying SG super late). Business funding assessments will become more stringent.

TRAP Employers will need to ensure their pay run calculations are correct each and every time (too bad if you make a mistake if say under the weather with the flu). No longer will you have the luxury of checking the super at quarter end when you know all of the last quarter’s pay runs are correct before paying the super.

Taxing of super balances in excess of $3,000,000

We have addressed this at the time of its announcement. No new details are to hand.

What concerns us is the advice that effects very few. In time it won’t. $3,000,000 may sound a lot but without any indexation the number of people who will fall foul of this will be in the millions.

Of particular concern is that it is wealth tax and moreover an unrealised wealth tax. It doesn’t tax income – it taxes the growth in your super over $3,000,000. You pay tax even if you haven’t sold the offending assets. One would get to $3,000,000 alone just by having invested $45,000 in After Pay at the float by the time of its peak (and then its value halved).

Closing remarks

And are we really going to have a surplus?

By a technicality or rather accounting tweak, yes we are.

From 2020/21 the budgetary surplus or deficit includes the growth in the Future Fund. That was rather a cheeky change as it’s like saying my overspending is OK cos I’m able to tap my super fund. Without its inclusion, this budget would be in deficit (and 2018/19 would have been in surplus – which kind of makes one wonder why the change in 2020/21).

Next steps

We welcome any question you may have.

We will though be undertaking more training on the Budget and thereafter update our pre year end tax planning checklist.

And this year’s tax planning will become a whole lot more interesting given the ATO’s new stance on distributions to adult children, the recent state case which alarmingly required a trust distribution to be overturned and the new requirements for professional firms to pay certain amounts to its principals (with a rather surprising definition on whom qualifies as a professional firm).

Entertainment (meals and FBT)

Entertaining clients, customers, employees and suppliers is a cost of doing business.

But the total cost of entertainment varies wildly depending on who does what with whom where and why. According to the ATO there are 38 consequential outcomes.

The main determinant of the outcome is which of three FBT methods is used to determine any Fringe Benefits Tax – those being:-

- Actual method (being the only method that provides an exemption for minor and infrequent expenditure).

- 50/50

- 12 week register.

Generally speaking, the smaller the business, the more attractive is the actual method (but again that depends on who is doing what with whom where and why).

The next consideration is what exemption can be used.

The actual method (which as stated above can only be used when the actual method has been chosen) exempts entertainment which is minor and infrequent and the cost per employee is less than per employee.

Also exempt is in house meals – being simple meals such as sandwiches.

You can read more here.

But the costs of getting it wrong is huge as the FBT tax rate is 47% (and that is without including fines and interest).

Please call us if you have any questions.

Important change to claiming home office expenses

Do you want to claim the home office expenses you are entitled to claim for 2022/23? Then read on as the ATO has made an important to change claiming home office expenses.

Furthermore, they apply from 1st March.

We have been able to claim under one of two methods:-

- A percentage of all costs based off the work area or

- A set rate per hour

The set rate per hour had been 52 cents per hour but an alternative rate of 80 cents per hour was offered from March 2020 to June 2022 to accommodate all of those working from home for the first time and who were not used to keeping records. The 80 cph rate was an all in rate. Only the 52cph rate allowed one to claim phone, internet and assets (whether claimed in full or depreciated). As I said, that 80cph rate is no longer available.

Please note that this post is not addressing claims where a business is run from home (with important capital gains tax implications). That will be covered in a future post.

A new rate is available from 1st July 2022 but please note:-

- The rate has increased from 52 to 67 cents.

- What the rate covers has changed.

- There have been important changes to the records required.

- But there is good news. The requirement to have an area set aside to undertake work activities has been removed.

What does the rate cover?

- Electricity and gas

- Home and mobile phone usage

- Internet connection usage

- Printing and stationery

The change is that other than electricity and gas, these costs could be claimed separately.

Depreciation is to be claimed separately

What records you now need to keep

- Receipts – but just one quarterly electricity or gas bill (I don’t know about you but I receive these bills monthly).

- A record of actual hours worked – no estimates. So you will need to keep timesheets, rosters, diaries and other such documents.

- You will need to keep these records for up to 5 years – even though most taxpayers are required to keep for less.

- Please note that for assets that are depreciated, one must keep the asset purchase receipt for 5 years from after the last depreciation claim. That could be 10 or 15 years after the date of purchase. We suggest moving a copy of the receipt into next year’s tax records when starting your record keeping for a new financial year.

A partial year concession

These new rules announced last week apply from 1st July 2022.

As a concession to those who haven’t kept a record of actual hours worked since 30th June 2022 to 28th February 2023, a reasonable estimate, or in the ATO’s words, a representative record, will suffice.

To be able to claim, you must keep an actual record of hours worked from 1st March 2023.

How to keep records

- Paper

- Electronic – including the ATO’s myDeductions tool (which you can access at https://www.ato.gov.au/General/Online-services/ATO-app/myDeductions/)

This is an important change which you need to adhere to claim home office expenses from 1st March 2023.

We welcome any questions you may have.

How to avoid making Christmas too taxing

Entertaining and providing gifts at Christmas time to staff, customers and suppliers is a cost of doing business. However, there are some important FBT, GST and income tax considerations and outcomes to keep in mind.

As an employer, you need to be careful at what you provide at Christmas. The rules are complex and the costs of getting it wrong can prove very expensive.

We will outline some of the more common scenarios and what to be careful of.

Under-pinning the implications are the following key points:-

- Christmas parties, entertainment and gifts are all treated under entertainment tax rules.

- FBT applies to benefits given to employees.

- There are no FBT implications on entertainment and gifts given to customers, clients and suppliers.

- There are three methods under which an employer can quantify the taxable components of any entertainment expenditure – in fact there are 38 permutations depending on who is entertained where, how and with whom. We will largely address the actual method which is the one used by most small businesses (as it usually results in the best outcome). It is beyond the scope of this briefing to address the 12 week log method and we will only touch upon the 50/50 method where relevant.

- Christmas comes but once a year and to the best of my knowledge and experience does so on 25th December. Nevertheless, the ATO treats Christmas parties and gifts as being what are called minor, infrequent and irregular benefits.

- Such minor benefits are FBT exempt where they cost less than $300 (including GST) provided the actual method is used to quantify entertainment.

The Christmas party

Where entertainment is calculated under the actual expenditure method (which is the most common method for small businesses):-

- A Christmas party is held on-site on a work day, the whole cost for each employee will be an exempt fringe benefit. So too will the spouse’s cost provided the cost per spouse is less than $300. No income tax deduction can be claimed for the cost of the party including that in respect of any family members that may attend. Taxi travel to or from the workplace (not both ways) will be exempt from FBT and not tax deductible.

- If a Christmas party is held off the work premises, then the whole cost will be exempt from FBT provided the party costs less than $300 per person (employees and their spouses). No income tax deduction can be claimed for the cost of the party including that in respect of any family members that may attend.

- If an external Christmas party costs more than $300 or more per person then the total cost is subject to FBT.

- The cost of any entertainment provided during the party (whether that be at the work premises or outside) will be exempt if it costs less than $300 per head – for example a DJ, musician, clown and comedian.

- The cost of entertaining clients, customers and suppliers is not subject to FBT and is not tax deductible.

- If any exemption is exceeded then FBT is payable. Consequently, an FBT Tax Return must be lodged and FBT paid (the FBT tax rate being the same as the top marginal tax rate). Please keep this in mind when completing the 2018/19 FBT Questionnaire in early April 2019.

- All other entertainment during the year will be subject to FBT on a case by case basis.

Where entertainment is calculated under the 50/50 method:-

- 50% of the cost will be subject to FBT and this portion will be tax deductible. The other 50% will not be subject to FBT and will not be tax deductible. An FBT Tax Return must be lodged and FBT paid.

- Only taxi travel from home to the venue will be FBT exempt and not deductible for tax.

- 50% of all other entertainment during the year will be subject to FBT.

Gifts

The following gifts are exempt from FBT and are tax deductible:-

- Hampers, bottles of wine, gift vouchers, a pen set costing less than $300 (inclusive of GST).

The following gifts are subject to FBT and are not tax deductible:-

- Tickets to a sporting event or theatre, holiday, accommodation, etc.

The GST treatment of gifts is:-

- The GST component of any tax deductible portion can be claimed back.

- The GST component that relates to the non tax deductible portion can’t be claimed.

Please do not hesitate to call us should you have any queries.

Are your PAYG or GST Instalments too high?

Quarterly BAS’s for the June 2022 quarter that contain GST or PAYG Instalments are due for lodgement this Thursday.

If your instalments for the year including June’s is close to the year’s actual liability then no action is required.

If either instalment is less then you will be asked to pay the shortfall by the time the 2022 Tax Return is lodged. You can though increase your June quarter instalment if you wish to not be sitting on the cash until May next year. This may also suit you if you are worried about not having the required funds when the shortfall(s) falls due.

But what if either instalment for June will take you well over what you are required to pay for the year?

If you do pay it, then it is not the end of the world as any excess amount will be refunded to you when the 2022 Tax Return is lodged. But why drain your funds in the meantime?

You are entitled to amend the instalment as issued by the ATO. But don’t get too carried away as the ATO does have the power to fine for gross under-estimates.

Do you think your instalments are too high? This is just one of the 67 items we address when undertaking pre year end reviews. So, if you are a client of ours then take comfort that we have already addressed this. If you are not a client, then we welcome a discussion.

I take the opportunity to state that the ATO has resumed normal operations. Since covid broke, they have not been chasing debts and lodgements. That has all changed as evidenced by the volume of letters and demands issued by the ATO since June. We have even heard of the ATO issuing Director Penalty Notices (DPN’s) to directors. DPN’s can be issued where a BAS obligation remains unreported and unpaid for more then 3 months. The scary part is that once issued, basically speaking, the only way to clear your now personal tax debt is to pay the tax due. Please don’t hesitate to call us if you are concerned about any request by the ATO.

2022 tax planning tips

With 30th June fast approaching, here is a list of common tax planning strategies that we have been discussing with clients:-

- Prepaid revenue can be deferred to the extent that it relates to next financial year and where a customer has the contractual right to cancel the contract at any time.

- Buying items such as stationery, printer cartridges, stamps, etc by Thursday 30th Those of you who entered the Simplified Tax System (STS) by 30th June 2005 (who are therefore automatically assessed on a cash basis) may wish to pay any bills not due until July like your phone bill, rent, printing and stationery, etc. Paying your accounting fees is also recommended!

- STS taxpayers are now known as Small Business Taxpayers (SBTs). SBTs now include taxpayers with an annual turnover under $50,000,000.

- As we have previously highlighted, SBTs can claim a full deduction of any assets acquired. But they must be in your possession ready to use. And if this means installation, then it must be installed before July.

- For more on the instant asset write-off, refer to recent blogs titled Parts 1, 2 and 3.

- SBT taxpayers can also claim a full deduction for payments such as insurances, rent and the like which cost more than $1,000 even though the service period runs past 30thJune and into the next financial year.

- For those of you who receive this e-mail that are employees or rental property owners, you can claim a complete write off for assets costing less than $300.

- If a property is jointly owned, then you can claim the full cost of assets costing less than $600 (meaning you claim less than the $300 limit each).

- Investors can claim prepayments in full. An investor with a property or share loan can claim a deduction for 12 months prepaid interest. Please note that the ATO requires that for the prepayment to be claimed, one must benefit through a lower interest rate (for which you need to keep proof).

- For those who have already generated a large capital gain, consideration should be given to selling other investments that have an unrealised capital loss. Those with no or minimal employer SGC support could consider making a deductible contribution into superannuation to offset the tax on the capital gain (but speak to a financial planner first).

- If you are about to sell an asset which will generate a capital gain, consideration should be given to selling it after 30th This will defer the payment of any capital gains tax liability until as late as early June 2024.

- Companies can accrue a director’s fee which is not payable until the following financial year. Why? – the company gets a deduction in this financial year but the director is not assessed on the income until the following financial year in which it is received. The trick is to document it correctly.

- If you have stock, count it (a separate e-mail will be sent to business clients with stock). As stock can legally be valued differently from item to item and from year to year, it can result in some advantageous outcomes.

- Donations are deductible. It must be a genuine donation so you can’t receive anything in return. Raffle tickets can’t be claimed.

- Our tax planning checklist also considers other items such as writing off bad debts, making Division 7A loan repayments, whether a company can reclaim past tax payments under the loss carry back rules, distributing to a new beneficiary and varying PAYG Instalments. How these and other opportunities are employed depends on your circumstances. We identify what you can do by running through our 67 point checklist.

All of the above tax planning tips are explained to our clients in any easy to read Tax Planning Report. And to give you more control over your cash flow, that report also sets out your income tax payments for the next 12 months.

We welcome any query about these tax planning tips.

We end this blog by taking the opportunity to remind you of:-

- The need for those who were directors before November 2021 to apply for their Directors Identification Number by early October at the absolute latest.

- Single Touch Payroll reporting fields will greatly expand under what is called STP2 and there is much preparatory work to be undertaken. And with STP2 now to be shared with Fair Work Australia, you don’t want to be getting it wrong! We encourage you to adopt the new system as soon as possible as any extension only causes more work later. Please let us know if you would like a referral to a payroll expert.