Posts Categorized: BAS and super obligations

March super payment reminder

Friday 26th April is the end date for satisfying Super Guarantee (SG) super obligations for the March 2024 quarter.

But as super clearing houses may take up to 8 days to pass the money through to the super fund, it means that processing and payment to the clearing house should be made no later than Tuesday 16th April.

Please note the ATO’s Small Business Clearing House has a much shorter clearance period – read more at https://www.ato.gov.au/businesses-and-organisations/super-for-employers/paying-super-contributions/how-to-pay-super/small-business-superannuation-clearing-house/clearing-house-terms-and-conditions

And please make sure you have been calculating SG super at 11% since it increased on 1st July 2023.

We take the opportunity to remind you that SG super is payable on all forms of remuneration including:-

- Commissions.

- Bonuses (but see below).

- Directors’ fees and all other forms of remuneration to directors.

- Allowances (except where fully expended).

- Individual contractor paid mainly for their labour.

But excluding the following forms of remuneration:-

- Overtime.

- Reimbursements.

- Unused annual leave on termination.

- Bonuses that are only in respect of overtime.

- Bonuses that are ex-gratia but have nothing to do with hours worked (harder to satisfy than what you might think).

- In respect of employees younger than 18.

- Employees carrying our duties of a private or domestic nature for less than 30 hours in a week (such as nannies).

- On quarterly remuneration greater than $62,270.

- Non-residents performing work for an Australian business outside Australia.

SGC super should never be paid late as late payments attract substantial interest and penalties. Furthermore, and SG (and BAS) liabilities that remain unreported and unpaid after 3 months automatically become personal debts of directors.

We welcome any question you might have.

SG deadline reminder for Dec 23 qtr

I trust you had an enjoyable festive season – but it is now time to focus on time critical obligations. So here is a quick SG deadline reminder.

With the 28th falling on the weekend and the Australia Day public holiday on the 26th, Thursday 27th January is the end date for satisfying your Super Guarantee (SG) super obligations for the December 2023 quarter.

Please make sure you do not confuse this obligation with the December quarter BAS. The December quarter BAS automatically has a one month extension to 28th February . There are no extensions for reporting and payment of SG super.

Please note that super clearing houses can take up to 8 days to pass the money through to the super fund. It therefore means that processing and payment to the clearing should be made as soon as possible.

And please make sure you have been calculating super at 11%% since it increased on 1st July 2023.

Please refer to our previous quarterly reminder as to what forms of remuneration are subject to and not subject to Superannuation Guarantee.

SG super should never be paid late as late payments attract substantial interest and penalties. Furthermore, SG (and BAS) liabilities that remain unreported and unpaid after 3 months automatically can become personal debts of directors.

We welcome any questions you might have.

SG super payment reminder

Friday 27th October is the end date for satisfying Super Guarantee (SG) super obligations for the September 2023 quarter.

But as super clearing houses may take up to 8 days to pass the money through to the super fund, it means that processing and payment to the clearing house should be made no later than this coming Wednesday.

And please make sure you have been calculating SG super at 11% since it increased on 1st July 2023.

And being the start of a new financial year, we take the opportunity to remind you that SG super is payable on all forms of remuneration including:-

- Commissions.

- Bonuses (but see below).

- Directors’ fees and all other forms of remuneration to directors.

- Allowances (except where fully expended).

- Individual contractor paid mainly for their labour.

But excluding the following forms of remuneration:-

- Overtime.

- Reimbursements.

- Unused annual leave on termination.

- Bonuses that are only in respect of overtime.

- Bonuses that are ex-gratia but have nothing to do with hours worked (harder to satisfy than what you might think).

- In respect of employees younger than 18.

- Employees carrying our duties of a private or domestic nature for less than 30 hours in a week (such as nannies).

- On quarterly remuneration greater than $62,270.

- Non-residents performing work for an Australian business outside Australia.

SGC super should never be paid late as late payments attract substantial interest and penalties. Furthermore, and SG (and BAS) liabilities that remain unreported and unpaid after 3 months automatically become personal debts of directors.

We welcome any question you might have.

Important SG super & payroll reminders

With the end of the March quarter comes some important SG super and payroll reminders.

Friday 28th April is the end date for satisfying Super Guarantee (SG) super obligations for the March 2023 quarter.

But beware as some of the clearing houses have a submission and payment deadline well before then. May be even next Tuesday!

SG super is payable on all forms of remuneration including:-

- Commissions

- Bonuses (but see below)

- Directors’ fees and all other forms of remuneration to directors

- Allowances (except where fully expended)

- Contractors paid mainly for their labour

But excluding the following remuneration:-

- Overtime

- Reimbursements

- Unused annual leave on termination

- Bonuses that are only in respect of overtime

- Bonuses that are ex-gratia but have nothing to do with hours worked (which is harder to satisfy than what you might think)

- Employees carrying out duties of a private or domestic nature for less than 30 hours in a week (such as nannies)

- On quarterly remuneration greater than $60,220

- Non-residents performing work for an Australian business outside Australia

If your payroll system has been set up correctly then it will perform these calculations for you. We would welcome the opportunity to assist you with this and if need be refer you to a good book-keeper.

SG super should never be paid late as late payments attract substantial interest and penalties. Furthermore, and SG (and BAS) liabilities that remain unreported and unpaid after 3 months become personal debts of directors.

So if you haven’t paid your employer super obligations already, we recommend doing so today!

We take this opportunity to remind you of the following matters:-

- The SG rate is currently 10.5%.

- We are currently following up any employing clients who have not returned their 2023 FBT questionnaire. You can read more in our email to employers of 31st March.

- Single Touch Payroll disclosures will be increase under what is called STP2. Your software provider will have and will continue to be in touch about what needs to be done – but please note their extensions are about to run out and you soon need to be fully compliant.

- Be very wary of this as STP2 permits Fair Work Australia to follow up any non-compliance, particularly in respect of under paid wages.

- Please be mindful that there is no longer a $450 threshold.

As always, we welcome your calling us to ask any question you may have.

80,000 – I don’t think so

How many are we being told will be affected by the excess upper tax? We are constantly told 80,000. 80,000 – I don’t think so.

Today Money Management published worrying findings from the Financial Services Council (SFC).

FSC’s modelling has shown that each of the following will breach the $3,000,000 threshold by the time they are 65:-

- A 55 year old earning $220,000 with a current super balance of $1,400,000 (not even half of the threshold).

- A 45 year old earning $150,000 with a current super balance of $650,000.

- A 25 year old earning $1000,000 with a current super balance of $35,000.

That 25 year old could be a IT professional as per FSC’s example – but it will also catch all those tradies working their socks off at the moment.

Seems to me that saying this proposed extra super tax will only hit very few is grossly misleading. In fact I question how many more than the often repeated 80,000 will exceed this threshold come 2025/26 – estimates I have read so far start at 500,000 – but it could be many more than that.

Think you may not be caught by the excess super tax – then read on

Think you may not be caught by the excess super tax – then read on.

The announcement as to levying extra tax on those people with total super balances over $3,000,000 has certainly caused a stir.

Treasury has already worked out how the system will work (contrary to what the Deputy Prime Minister said on the Friday morning TV news).

So let’s explore how quickly people will start to pay this tax given the threshold will not be indexed. And to put it into perspective let’s first look at the time value of money.

$3,000,000 may sound a lot today – but you could buy family home in many parts of Melbourne 30 years ago for less than $100,000.

And look at it this way:-

- In 2013 Labour was floating exempting the first $100,000 of a super pension being paid from an accumulation (not to be confused with the extremely generous defined benefits that politicians and senior public servants received – which have escaped the current round of fire).

- In 2016, the then reigning Liberal government introduced a Transfer Balance Cap (TBC) of $1,600,000 – being an indexed maximum amount you could have in pension mode). $1,600,000 earning a modest return of 6% would equate to almost $100,000.

So it can be said that even though 3 years apart, both parties had a similar idea as to what a reasonable super balance in retirement capped out at.

So what are those amounts worth today?

The $1,600,000 was indexed to $1,700,000 from 1st July 2021. Whilst that took 4 years, it has only taken another 2 years for inflation to jack it up to $1,900,000 which it will be from 1st July 2023. So what will it be by 1st July 2025? Very possibly at least $2,000,000 but more likely $2,100,000 the way inflation is running.

$3,000,000 may sound like a lot but the time value of money means it is worth a lot less than what most people think.

No wonder predictions are 500,000 mum and dad Australians will breach this cap come 2025/26. And how many by 2030? Roll forward to 2055 and it could be an alarming number (noting how house prices have inflated from 30 years ago).

So what does this mean to Fred who retires at the start of 2025/26 with $2,000,000 in super?

Fred (with a life expectancy of +/- 20 years) makes a downsizing contribution from the sale of his home of $300,000 (downsizing being a policy supported and widened successively by both parties).

Good investing could see his super earn 4% franked dividends and with growth of 5.25% – the return would be 11%. In this case, Fred will start paying this extra tax from the 2029/30 year – it has only taken 5 years to fall into the system! He started at only 2/3rds of the threshold but has breached it within 5 years.

And what if Fred is solely in accumulation for personal reasons? Well he will fall into the system from the fourth year.

And what does this mean for the 2029/30 year? In the first year the tax will only be $860.

But by 2038 the tax has grown to $27,221. Seems a lot of tax to me particularly if the supporting assets haven’t been sold – and may even fall in value. Roll forward another 5 and 10 years and the numbers start becoming eye watering (noting that one is taxed on the growth even if the assets aren’t sold or subsequently fall in value – think PayPal’s fall from its highest price to when it delisted).

And what about Jack who has $2,000,000 in super today?

Jack retires at age 65 in 2025/26 at which time he makes a downsizing contribution in addition to three years of making maximum super contributions (net of 15% tax). Well Jack has the honour of being levied the excess tax from 2026/27. Fred has started with $2,000,000, followed the rules, but is subject to this new excess tax from just its second year!

It is misleading to say this only affects 80,000 Australians. As every year goes by, an increasing number of Australians will have their retirement savings eroded by this tax.

It will be interesting to see modelling of how many current 25 year olds will fall into the system by the time they reach age 65.

SG deadline reminder

I trust you had an enjoyable festive season – and back into it we go! So here is a quick SG deadline reminder.

Friday 27th January is the end date for satisfying your Super Guarantee (SG) super obligations for the December 2022 quarter.

Please make sure you do not confuse this obligation with the December quarter BAS. The December quarter BAS automatically has a one month extension to 28th February to all. There are no extensions for reporting and payment of SG super.

Please note that super clearing houses take up to 8 days to pass the money through to the super fund. It therefore means that processing and payment to the clearing should be made as soon as possible.

And please make sure you have been calculating super at 10.5% since it increased on 1st July 2022.

SG super should never be paid late as late payments attract substantial interest and penalties. Furthermore, SG (and BAS) liabilities that remain unreported and unpaid after 3 months automatically become personal debts of directors.

We also take this opportunity to remind you of the imminent migration to Single Touch Payroll 2 with its extra reporting requirements. Please do not hesitate if you would like an introduction to a payroll specialist.

We welcome any questions you might have.

Are your PAYG or GST Instalments too high?

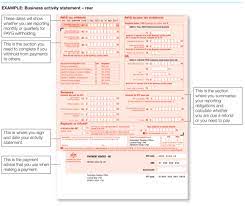

Quarterly BAS’s for the June 2022 quarter that contain GST or PAYG Instalments are due for lodgement this Thursday.

If your instalments for the year including June’s is close to the year’s actual liability then no action is required.

If either instalment is less then you will be asked to pay the shortfall by the time the 2022 Tax Return is lodged. You can though increase your June quarter instalment if you wish to not be sitting on the cash until May next year. This may also suit you if you are worried about not having the required funds when the shortfall(s) falls due.

But what if either instalment for June will take you well over what you are required to pay for the year?

If you do pay it, then it is not the end of the world as any excess amount will be refunded to you when the 2022 Tax Return is lodged. But why drain your funds in the meantime?

You are entitled to amend the instalment as issued by the ATO. But don’t get too carried away as the ATO does have the power to fine for gross under-estimates.

Do you think your instalments are too high? This is just one of the 67 items we address when undertaking pre year end reviews. So, if you are a client of ours then take comfort that we have already addressed this. If you are not a client, then we welcome a discussion.

I take the opportunity to state that the ATO has resumed normal operations. Since covid broke, they have not been chasing debts and lodgements. That has all changed as evidenced by the volume of letters and demands issued by the ATO since June. We have even heard of the ATO issuing Director Penalty Notices (DPN’s) to directors. DPN’s can be issued where a BAS obligation remains unreported and unpaid for more then 3 months. The scary part is that once issued, basically speaking, the only way to clear your now personal tax debt is to pay the tax due. Please don’t hesitate to call us if you are concerned about any request by the ATO.

June quarter employer obligations

There are a number of important employer obligations that you will need to satisfy by 28th July.

Whilst 28th July is the end date for paying the June quarter SG super, payments through clearing houses can take up to 6 to 10 days. We therefore recommend that you pay your June quarter super today if you have not done so already.

Those larger employers that are subject to Pay-roll Tax are due to certify the 2021/22 remuneration by 21st July. One needs to be careful as in addition to wages, salaries, commissions, directors fees, bonuses and so on, Pay-roll tax is also payable on:-

- Superannuation

- Some fringe benefits

- Payments to certain contractors (including some corporates).

Although you may have a WorkCover lodgement date as late as March next year, it would also be prudent to certify your 2021/22 WorkCover remuneration now.

We take this opportunity to remind you that 14th July was the due date for Single Touch Payroll finalisations (with extended dates for closely held employees).

We welcome any question you may have about these matters.

What are the new super limits?

So what are the new super limits that apply to this financial year and then from July 2022?

Please click here to access super limits about:-

- How much money can be put into super.

- How it is taxed whilst in the fund.

- Tax and limits on money being paid out of super.

Under the Corporations Law, the following are all personal advice:-

- Advising on whether you should make any form of contribution.

- Start or stop a pension.

- Whether to withdraw money as a pension or lump sum.

- Accountants are unable to provide such personal advice – that is unless they are otherwise licensed as a financial planner.

And it is with good reason this is so. Too often people decide upon a course of action for which they are unaware is not in their best interests, whether that be in the short or long term.

Furthermore, those with own self managed super fund can embark on a course of action which leads to either a fineable breach or restrict the amount of money that could otherwise be concessionally taxed.