Negative Gearing

Negative Gearing is a mysterious term but one which simply means that the interest costs on borrowings exceed the investment’s income.

Hopefully the investment over time generates positive rather than negative income. Moreover, one also hopes the eventual capital gain exceeds the net income losses by some margin, particularly on a time value basis.

Australian love to buy rental properties. However, it is risky and many do so without understanding what the costs and benefits may be.

We can help when you decide to buy a rental property by:-

- Referring you a trusted buyer’s advocate.

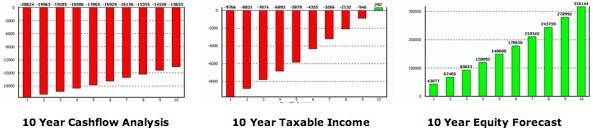

- Model the tax outcome. We have a specialised software program which will model the tax and cash flow outcomes as well as expected increase in equity. Use us and take all the guesswork out of it and be able to sleep at night.

- Prepare your Tax Return using our comprehensive checklist to ensure you claim all the deductions you are entitled to.

- If the tax losses are causing you cash flow problems and you prefer not to wait until your Tax Return is lodged to receive your tax refund, we can prepare an application to have your tax from your wages reduced.

- Set you up with a system to best track your rental property expenses thereby simplifying the preparation and cost of preparing your annual Tax Return.

- Establish proper Capital Gains Tax cost base records to ensure the eventual capital gain/loss correctly accounts for all costs so that you needlessly don’t pay too much tax.

- Discuss Capital Gains Tax, Stamp Duty and Land Tax issues when and before they arise.

We have the perfect tool to manage your property which makes completing your Tax Returns easy and gives you peace of mind that you have the Capital Gains Tax information you need when you finally come to dispose of the property.