Posts Categorized: BAS and super obligations

What’s in the Budget for you?

What’s in the Budget for you?

Probably significantly more than you think.

As what is now unfortunately the norm, there were plenty of pre-announcements before Budget night. But there is much more to the Budget that was announced on Budget night or leading up to it.

In addition to some key business announcements (extension of loss carry back company rules and instant asset write-off) there were very welcome announcements to being able to getting more money into super. Welcome I say as how can one provide for retirement with a contribution cap – which currently sists at $25,000 before being eroded by 15% tax, life insurance premiums and for some an extra 15% tax).

Also of note were the proposed changes to personal and self managed super fund residency rules. I say welcome as the existing rules are quiet archaic in context of how people today live, work and travel – mind you we still aren’t going anywhere for a while with covid.

We will explore some of the key measures in our next survive and thrive webinar. It will beheld at 5.30pm on Wednesday 2nd June and you can book here – https://tinyurl.com/reg0206

We will also flesh out some opportunities in upcoming blogs.

But having said all that, please keep in mind that:-

-

A Budget is only ever a series of announcements,

-

They still have to be legislated,

-

They may be changed slightly and

-

Many have start dates form July 2021 – and we may have a change of government before then.

Please though don’t hesitate to call us if you any questions.

Urgent SG super reminder

Wednesday 28th April is the end date for satisfying Super Guarantee (SG) super obligations for the March 2021 quarter.

But beware as some of the clearing houses have a submission and payment deadline well before then. May be even today!

SG super is payable on all forms of remuneration including:-

-

Commissions

-

Bonuses (but see below)

-

Directors’ fees and all other forms of remuneration to directors

-

Allowances (except where fully expended)

-

Contractors paid mainly for their labour

But excluding the following remuneration:-

-

Overtime

-

Reimbursements

-

Unused annual leave on termination

-

Remuneration of less than $450 in a month

-

Bonuses that are only in respect of overtime

-

Bonuses that are ex-gratia but have nothing to do with hours worked; which is harder to satisfy than what you might think

-

In respect of employees younger than 18

-

Employees carrying our duties of a private or domestic nature for less than 30 hours in a week (such as nannies)

-

On quarterly remuneration greater than $57,090

-

Non-residents performing work for an Australian business outside Australia

If your payroll system has been set up correctly then it will perform these calculations for you. We would welcome the opportunity to assist you with this and if need be refer you to a good book-keeper.

SG super should never be paid late as late payments attract substantial interest and penalties. Furthermore, and SG (and BAS) liabilities that remain unreported and unpaid after 3 months automatically become personal debts of directors.

The SG rate remains at 9.50%.

So if you haven’t paid your employer super obligations already, we recommend doing so today!

Why is the ATO suddenly asking you for money?

If you want someone to pay you then it is a good idea to send them a bill so they can. Seems like common sense – but not to the ATO.

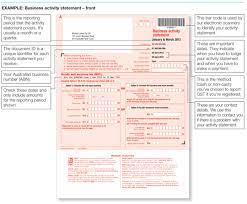

A number of clients have been surprised, offended and/or doubtful of recent payment requests from the ATO. This happened as the ATO elected to cease sending paper activity statements. It seems as though many did not receive a reminder through their MyGov account – or if they did, ignored it legitimately thinking it was a scam.

So will you get into trouble?

The answer is no.

We understand that the ATO will revert to issuing paper statements.

We do though recommend periodically checking your MyGov account just in case you have missed something. Once you have opened a My Gov account, they will no longer issue you with a physical assessment notice; even we aren’t issued with one. They also cease issuing super S293 notices and the like.

But never click on a link within a MyGov email as it may well be a hoax. Log in separately from your internet browser.

Am I paying the right award wage?

Awards set out employment conditions and minimum pay rates.

There are over 100 industry based awards and they cover most workers in Australia. That said, whilst financial planners come under an award, accountants don’t; but some workers within an accounting firm may come under an office award depending their duties.

Larger employers with a registered agreement in place have the terms of that agreement over-rule any award(s) that may otherwise be applicable.

Awards can also determine what the default super choice fund. No wonder industry super funds have go to be so big!

So with all this complexity it’s important to make sure you pay under any applicable award. But how do you do that?

You can find a list of awards at – https://www.fairwork.gov.au/awards-and-agreements/Awards/list-of-awards

Better yet, you can see what awards that may relate to your employees at Fair Work Australia’s award checker – https://www.fairwork.gov.au/awards-and-agreements/awards/find-my-award/ Please also refer to clause 4 as that is usually the clause that sets out who is covered by the award. You can also check the most important job classifications which can usually be found within the pay clause or a schedule.

Super guarantee (SG) super deadline

Wednesday 28th October is the end date for satisfying Super Guarantee (SG) super obligations for the September 2020 quarter.

But beware as some of the clearing houses have a submission and payment deadline well before then. May be even today!

SG super is payable on all forms of remuneration including:-

-

Commissions.

-

Bonuses (but see below).

-

Directors’ fees and all other forms of remuneration to directors.

-

Allowances (except where fully expended).

-

Contractors paid mainly for their labour.

But excluding the following remuneration:-

-

Overtime.

-

Reimbursements.

-

Unused annual leave on termination.

-

Remuneration of less than $450 in a month.

-

Bonuses that are only in respect of overtime.

-

Bonuses that are ex-gratia but have nothing to do with hours worked (harder to satisfy than what you might think).

-

In respect of employees younger than 18.

-

Employees carrying our duties of a private or domestic nature for less than 30 hours in a week (such as nannies).

-

On quarterly remuneration greater than $57,090.

-

Non-residents performing work for an Australian business outside Australia.

SG super should never be paid late as late payments attract substantial interest and penalties. Furthermore, and SG (and BAS) liabilities that remain unreported and unpaid after 3 months automatically become personal debts of directors.

The SG rate remains at 9.50%.

So if you haven’t paid your employer super obligations already, we recommend doing so today.

JobKeeper – can I claim and how do I claim?

|

Whilst many businesses cannot claim the PAYG withholding (wages tax) Cash Flow Boost, many more businesses will be able to claim JobKeeper. Under this stimuli, the government will pay to each qualifying business a flat $1,500 per employee per fortnight. I say business as the scheme is also open to non-employers such as sole traders, partner of a partnership, a beneficiary of trust and one director of a company. Even the first JobKeeper payment fortnight has already passed, the registration process will start next week. The window for that is effectively open for a very short period of time. Don’t register – no soup for you! On Monday, will run a webinar in which you will learn:-

LEARNING OBJECTIVE – by attending this webinar you will:-

Effectively we are giving all of this to you on a plate as this has all been built, collated, summarised and systematised on the back of hours attending technical webinars and reading the mountainous pile you can see in the photo below. |

Please click on the following link to register for the webinar at 4pm on Monday 20th April:-

https://zoom.us/webinar/register/WN_KgK3mKcUQHunYb2PW7hwjA

Another webinar will be run if there is sufficient overflow. If you can’t attend Monday’s webinar then please action the following matter.

IMPORTANT – you need to register your interest with the ATO IMMEDIATELY if you have not done so already. This interest notification merely advises the ATO that you intend to claim; it is not in itself registration. To register your interest, please refer to our blog at:-

https://www.mrsaccountants.com.au/category/covid-19-strategies/

or

https://www.mrsaccountants.com.au/register-for-1/

We remind you to keep referring to our web page for important daily blogs, tips and strategies.

Lodgments and ATO assistance

It is critical that you keep:-

-

Lodging activity statements.

-

Reporting under Single Touch Payroll

-

Meet your super guarantee obligations

Whilst there are various forms of relief available, you are still required to meet all your ATO compliance obligations.

And whilst there are payment extensions to a certain ATO taxes or some are being waived, there is no extension in regard to employee super. It is also important to note that the two-part penalty of a 200% penalty and non-deductibility of anything paid late remains in place.

Paying employee’s super has always been a business’s number one obligation; now even more so!

The deadline for reporting and paying March quarter superannuation is April 28. As some clearing houses take up to 8 business days to pass on any payment into a super fund, we strongly recommend paying the super by this time next week.

The stimulus packages include such concessions being able to vary the March quarter PAYG instalment to nil (and claim back any instalments paid for the September and December quarters), not paying January to June PAYG withholding and up to a six-month deferral for paying bases, tax shortfalls & FBT liabilities.

We remind you not to lodge your March quarter BAS without speaking with us first.

We take this opportunity to remind you to return to this web page for daily blogs on a variety of short videos and business survival tips (including health and well being).

As we are all in this together, we are determined to help as many business owners as possible. We would therefore appreciate you passing on a link to any article you find of interest to your team, family, friends and business associates.

Register for #1

There are a number of benefits and stimulus incentives that business owners should register for ASAP.

#1 would be to register for the JobKeeper scheme.

Even if you think you don’t qualify or don’t qualify based off March 2020, we recommend registering now.

You can do so at :-

https://www.ato.gov.au/general/gen/JobKeeper-payment/

Please return to our web site for other suggested registrations and new stimulus benefits as they arise.

We are also welcome any query you may have.

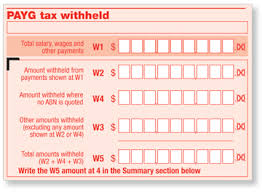

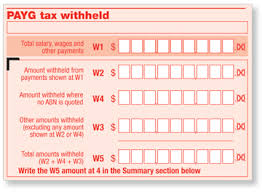

Am I eligible for PAYG Withholding relief?

By far the most common question being asked now by small businesses is am I eligible for PAYG withholding relief?

There have been two announcements with the effective doubling of the concession on the second stimulus package as announced last Sunday.

That package was rushed through Parliament earlier in the week. Whilst we now have some clarity, questions still remain.

To qualify a business must:-

-

Have an ABN by March 12, 2020. This is an obvious requirement to avoid restructuring.

-

Make a payment of salary and wages (or directors fees, commissions etc). It doesn’t matter that there may be no requirement withhold PAYG withholding if the wages are small.

-

Either have (a) lodged the 2019 Tax Return by March 12, 2020 which reports assessable business income or (b) lodged an activity statement for the 2019/20 year which declares business income (which is presumably either sales subject to GST and/or business income subject to PAYG Instalments).

-

The entity has not engage in a scheme for the sole or dominant purpose of seeking to make the entity entitled to the payment would increase entitlement entity to the payment. In other words, tax avoidance.

The ATO has also stated that they will review sudden changes to the characterisation of payments and investigate whether the payments are in fact wages. This is quite reasonable where PAYG withholding and not been reported and SG super contributions had not been made. We also note that some people who may wrongly trying claim may have a hard time proving so where there is no WorkCover policy in place. This is much easier for the ATO to determine given the introduction of Single Touch Payroll for all employers from July 2019.

However, questions do remain.

In particular, it is very common for a business owner to only draw a salary at the end of the financial year when the business is known to be profitable. It would be most unfair if they were to miss out.

We will post further information when matters are made clearer.

In the meantime:-

-

We would be happy to answer any question you may have.

-

Ask you to keep returning to this section as blogs will be posted at least twice daily

Tax-free “payments” to employers

The main plank to the first and second government stimulus packages has been the announcement of tax-free payments to employers.

It is been incorrectly reported as a payment to employers.

However, there will not be a payment in all cases.

It will be either:-

-

Larger employers will not pay the first $50,000 of PAYG Withholding in respect of the months January to June inclusive (they can also benefit in the first half of 2020/21 but we will cover that in a future blog).

-

Employers who withhold less than $10,000 of PAYG Withholding per year, they will receive a minimum credit of $10,000. If that $10,000 is greater than the other BAS liabilities, then the balance will be paid to the employer.

For those that report PAYG Withholding monthly, they can claim the credit for January and February on the March BAS.

The ATO best describes this as a Cash Flow Boost.

Employers will still be allowed to claim all of the PAYG Withholding as a tax deduction – even though it is not paid.

Employees will still be allowed to claim a tax refund for all of the PAYG Withholding reported – even though the employer has not paid some or all of it.

The ATO has stated that they will pay refunds within 14 days.

Please come back to read updates on how you can benefit from this concession. We also welcome any question you may have.